UrbanScale: A Public Bond Market Built for the Web

Rethinking Access to Public Bonds

Municipal bonds aren’t new—they’ve long funded schools, roads, hospitals, and other essential infrastructure. But access to these bonds has remained strangely opaque and inefficient. Trades are often private, fees unpredictable, and information hard to come by.

UrbanScale is a small attempt at changing that. It’s a browser-based interface for issuing, discovering, and purchasing public bonds directly. Anyone can browse available issuances, inspect the terms, and purchase them through an on-chain interface that’s connected to your wallet.

Try the Demo

Watch the Walkthrough

What UrbanScale Does

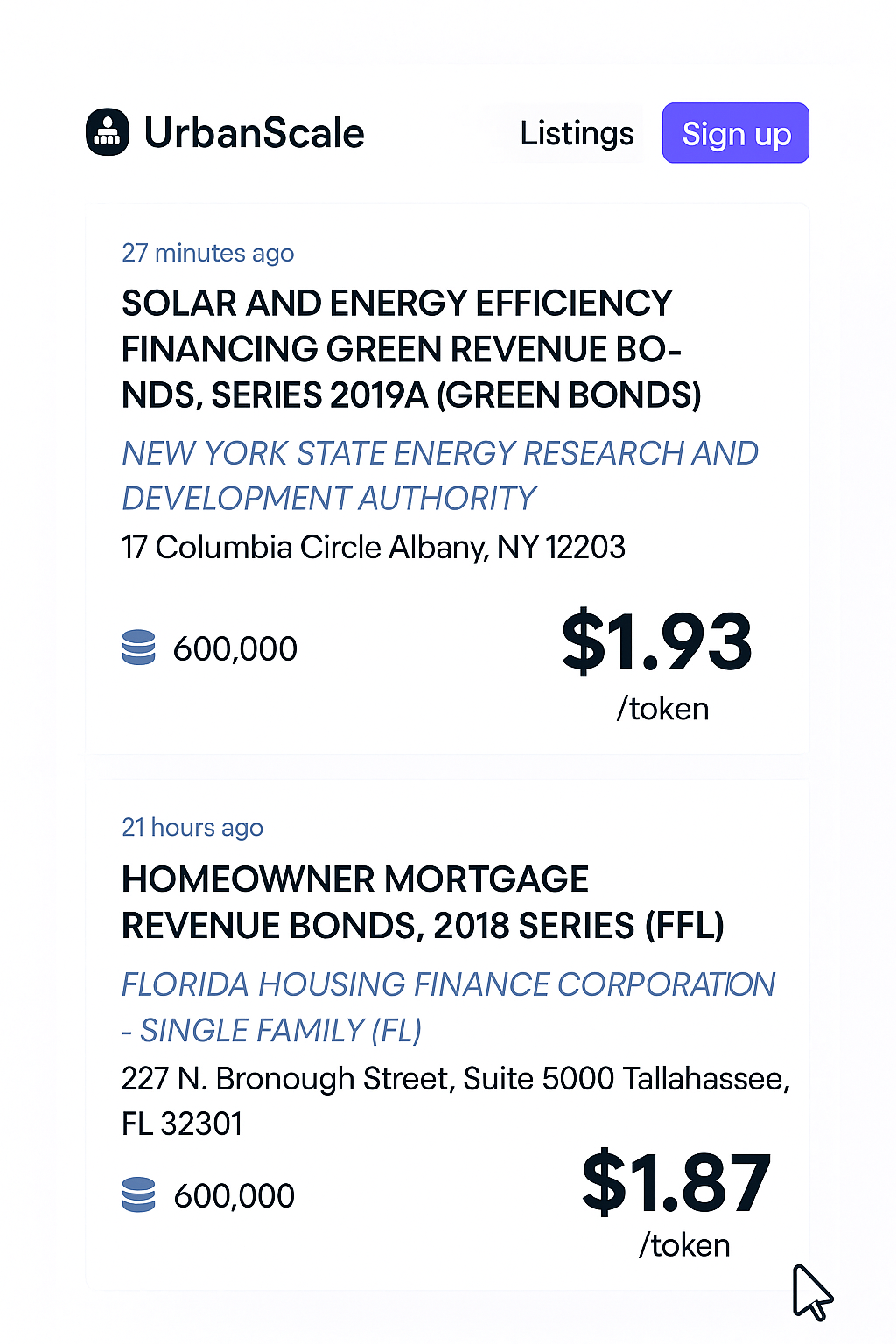

- Makes Public Bonds Browseable: The app shows a feed of available public bonds, each with summaries, terms, and purchase options.

- Simplifies Onboarding: You can log in using social credentials and connect with wallets like MetaMask or Portis.

- Enables Transparent Purchases: Bonds are represented as ERC-20 tokens, which makes the purchase and ownership feel more direct and measurable.

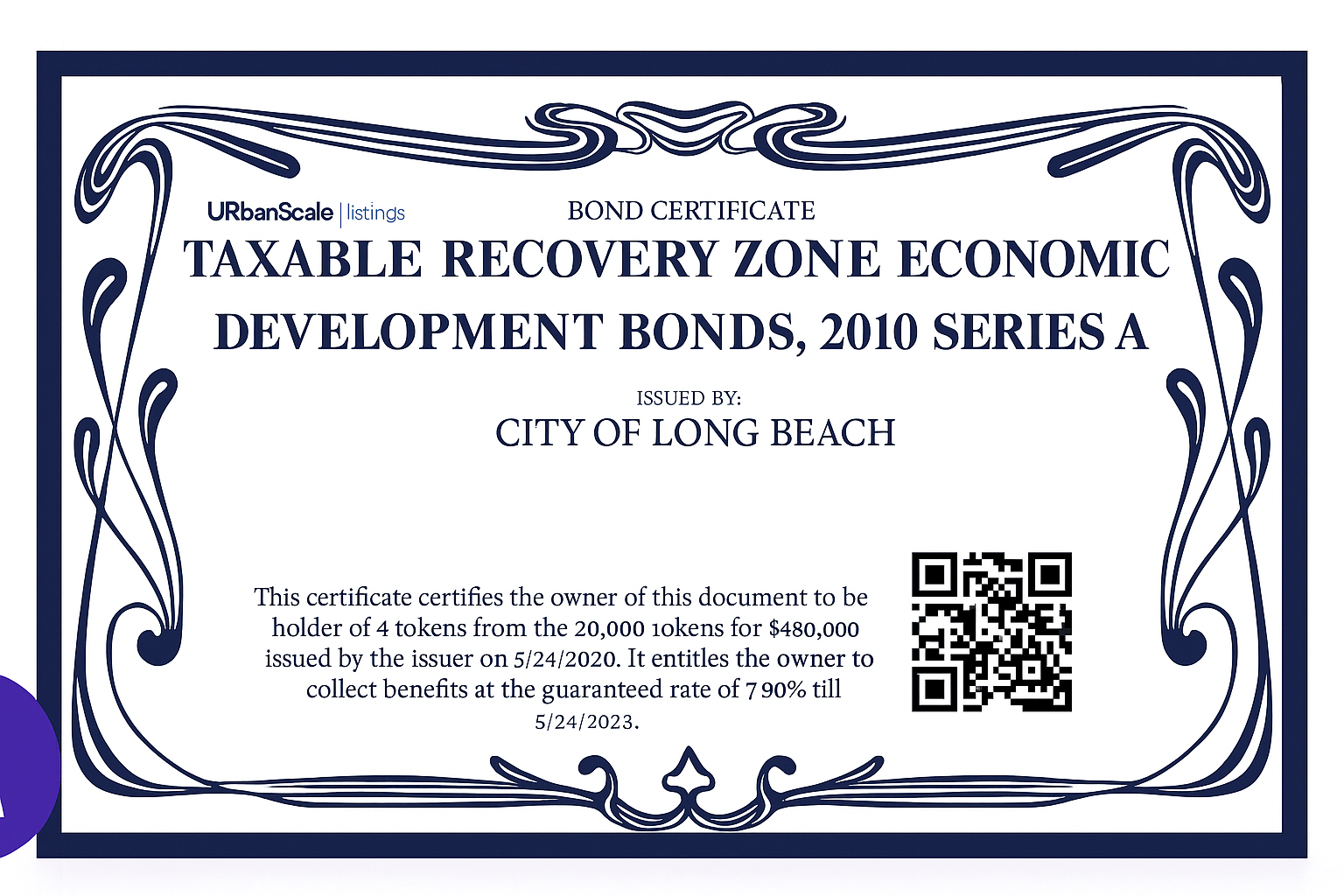

- Provides Certificates: After a bond is purchased, users receive a digitally signed certificate with a QR code for easy verification.

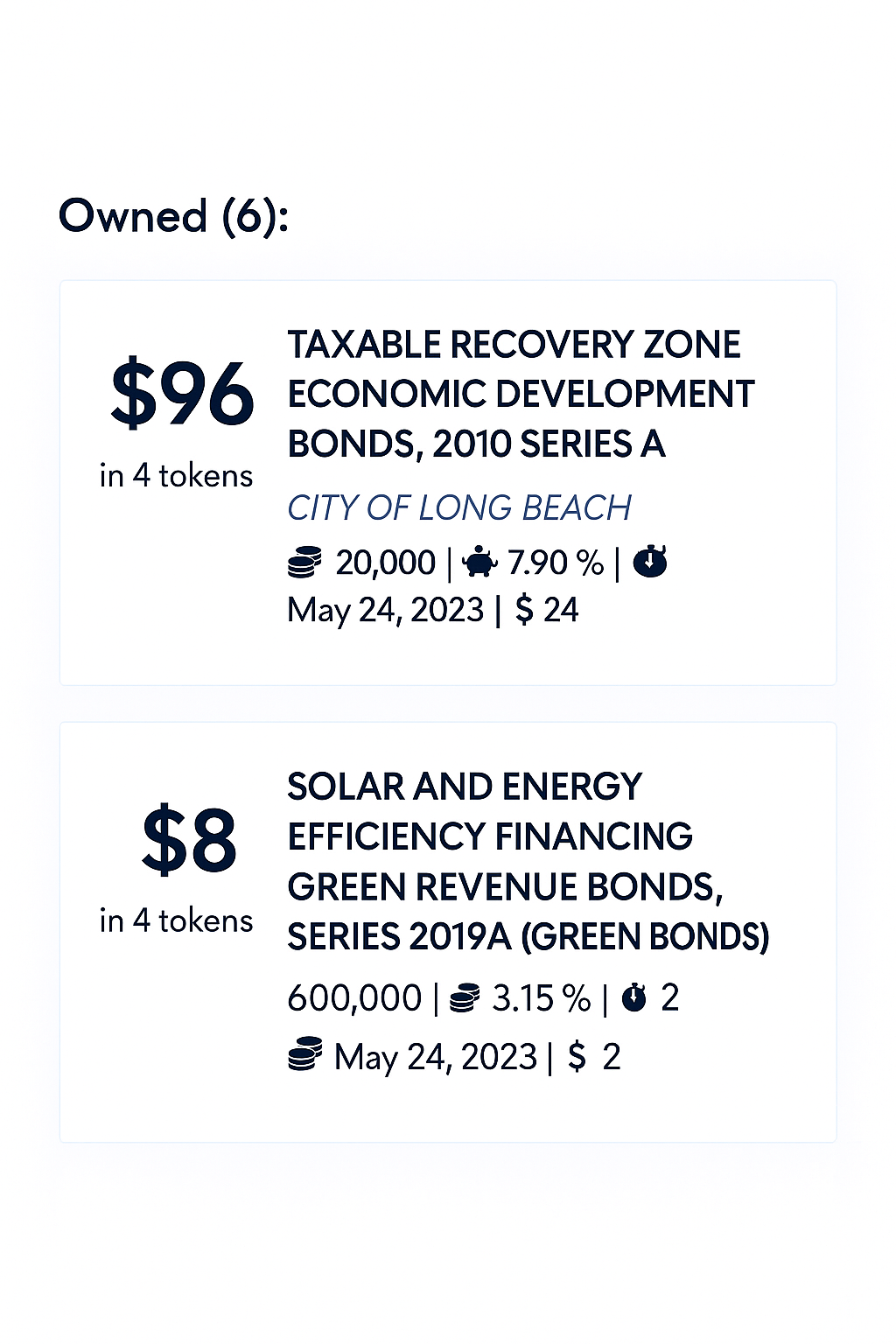

- Builds a Personal Portfolio: All your holdings are available to view, complete with market status and transaction history.

How It Works

When a public institution wants to raise money through a bond, they can use UrbanScale to publish a listing. Data is pulled from sources like FEMA (the government bond database), which helps pre-fill much of the issue information.

From there, issuers enter the total amount being raised, expected returns, and any contextual details about how the funds will be used. Once submitted, the bond appears on the public listing page and is available for purchase.

Purchasers simply select the number of tokens (representing shares of the bond) they wish to buy, and confirm the transaction through their wallet.

Why This Approach Feels Different

UrbanScale is a frontend-first tool. There’s no need to navigate traditional broker platforms or interpret confusing markups. It brings together a few things:

- Open Data: Uses public datasets to populate available bonds.

- Web3 Interactions: ERC-20 tokens for purchase and ownership.

- Self-Custody: You own your bonds directly through your connected wallet.

- Trade-Ready Format: The token model opens doors for future secondary markets, without requiring the user to wait on platform updates.

The whole experience is designed for transparency and ease. It doesn’t aim to disrupt or revolutionize bond markets—but it does make them more visible, understandable, and interactable.

Final Notes

UrbanScale is still experimental. Some parts are hard-coded, some flows are rough, and the token model will need work to support full secondary trading. But even in this form, the project reveals what’s possible when we apply modern web tools to old civic processes.

If you’re curious about financial transparency, government interfaces, or Web3 civic tools, it’s worth poking around.